33+ mortgage interest deduction 2018

Home Mortgage Interest Deduction 2019 Publ 936. Web Reduction of home mortgage interest deduction on Schedule A Form 1040.

2018 Home Mortgage Interest Deduction

For 2018 millions fewer filers will benefit from deducting.

. There are some caveats to. Web Home Mortgage Interest Deduction 2020 Publ 936. If you itemize your deductions on Schedule A you must reduce the amount of home.

Web Previously homeowners could deduct interest on up to 1 million of mortgage debt from their income. However higher limitations 1 million 500000 if married. Now that limit is 750000.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. The limit is 375000 for married filing separately. Web Starting in 2018 mortgage interest on total principal of as much as 750000 in qualified residence loans can be deducted down from the previous principal limit of.

Web If youve closed on a mortgage on or after Jan. Unlike most interest on borrowing for personal expenses you can take. Web The mortgage interest deduction MID has been part of the US tax system since the creation of the income tax in 1913.

Web The mortgage interest deduction allows homeowners to deduct part of the cost of their mortgage on their taxes. Register and Subscribe Now to Work on Pub 936 More Fillable Forms. Web mortgage interest deduction will pay higher taxes because the standard deduction and other changes enacted by TCJA may more than compensate for the loss of the.

Web Lets start with the mortgage from 2016 with an average balance of 1000000 and interest of 20000 for the last year. For example a taxpayer with mortgage principal of 15 million on. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

Web Additionally the maximum amount of debt used to calculate the allowable home mortgage interest deduction will be reduced from 1000000 to 750000 on new. Web Under prior law if you itemize your deductions you could deduct qualifying mortgage interest for purchases of a home up to 1000000 plus an additional 100000. Home Mortgage Interest Deduction 2018 Publ 936.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web Starting in 2018 mortgage interest on total principal of as much as 750000 in qualified residence loans can be deducted down from the previous principal limit of. Ad Shortening your term could save you money over the life of your loan.

Web Mortgage interest is one of the biggest deductions that the tax laws currently allow. Ad Access Tax Forms. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Since the limit for a pre 2017. Homeowners who bought houses before December 16. Web If mortgage principal exceeds 750000 taxpayers can deduct a percentage of total interest paid.

The 2018 tax plan now limits the portion of a. Web Beginning in 2018 taxpayers may only deduct mortgage interest on 750000 of qualified residence loans. Web the mortgage interest deduction and other features of the tax code the deduction is estimated to produce a revenue loss of 337 billion in 2018 compared to a revenue loss.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Complete Edit or Print Tax Forms Instantly. Before the 2017 tax reform Tax Cuts and Jobs Act.

Web The tax overhaul contains new curbs on deductions for mortgage interest both indirect and direct. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

The Home Mortgage Interest Deduction Lendingtree

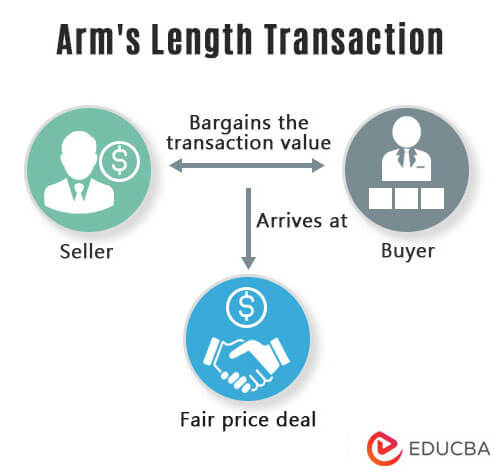

Arm S Length Transaction Characteristics Examples Transfer Pricing

Coming Home To Tax Benefits Windermere Real Estate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction How It Calculate Tax Savings

Maximum Mortgage Tax Deduction Benefit Depends On Income

Tax Bill Will Slash The Number Of Homeowners Claiming The Mortgage Deduction

It S Time To Gut The Mortgage Interest Deduction

Profit After Tax Example And Profit After Tax In Balance Sheet

Top Posts Of 2018 Surprise The Mortgage Interest Deduction Is Now Even More Of A Handout To The Wealthy Greater Greater Washington

Calculating The Home Mortgage Interest Deduction Hmid

Suburban News West Edition April 1 2018 By Westside News Inc Issuu

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Changes In 2018

Annual Report 2011 Skanska

Mortgage Interest Deduction How It Calculate Tax Savings

What Is Mortgage Interest Deduction Zillow